The important stuff about your extras cover

Because you've got extras cover with ahm, we’ll help with bills for things like routine dental check-ups, chiro and physio.

The types of services included on your extras cover depend on the level of cover you've got. Generally, the higher the level of cover, the more services you can claim benefits towards.

It's easy to find the benefit back amount for common items. Just click the name of the service you're interested in.

If the item you're looking for isn't shown here, you can check the benefit back calculator. You can also find this tool under Overview > Benefit back calculator.

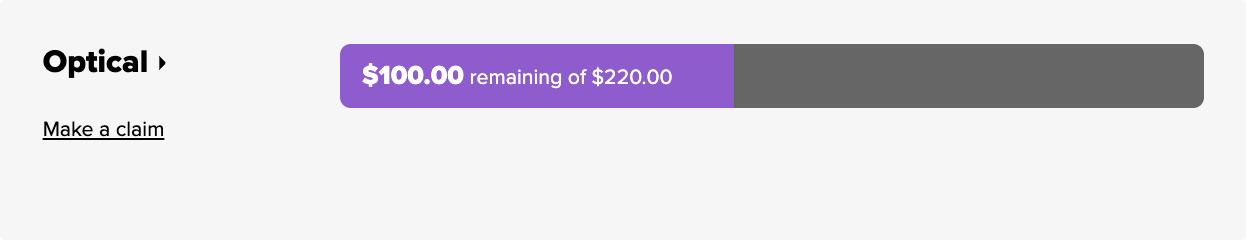

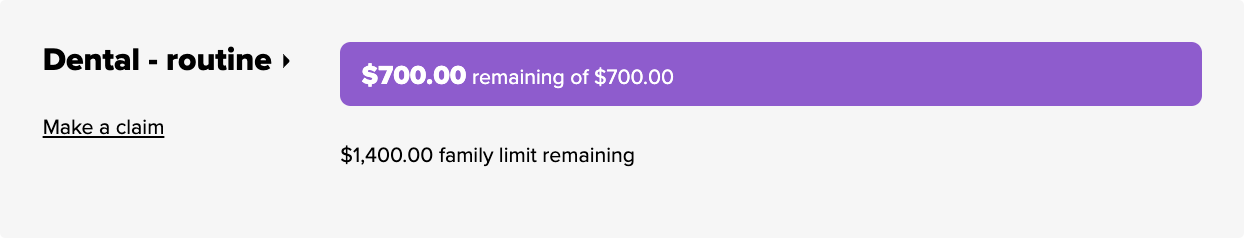

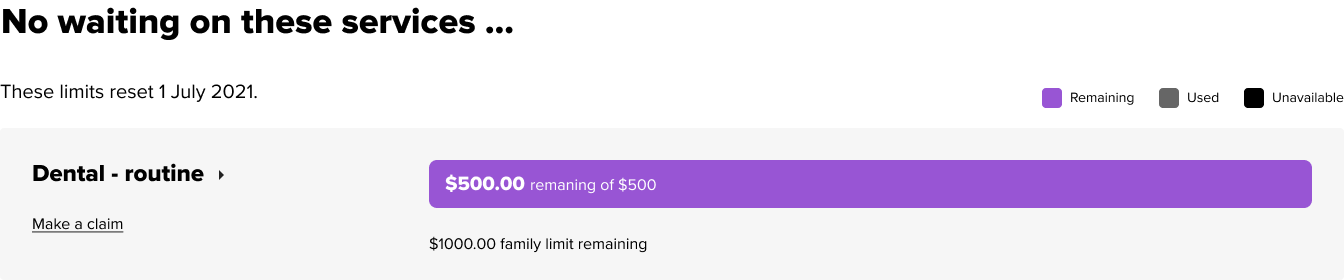

Most extras services are subject to annual limits, which is the maximum amount of benefit that you can claim towards that service in each financial year. In some cases, like orthodontics, a lifetime limit will apply. Make note of the annual limits and other limits for your extras cover to make sure you've got all the info.

And remember that all extras limits are per financial year, not calendar year.

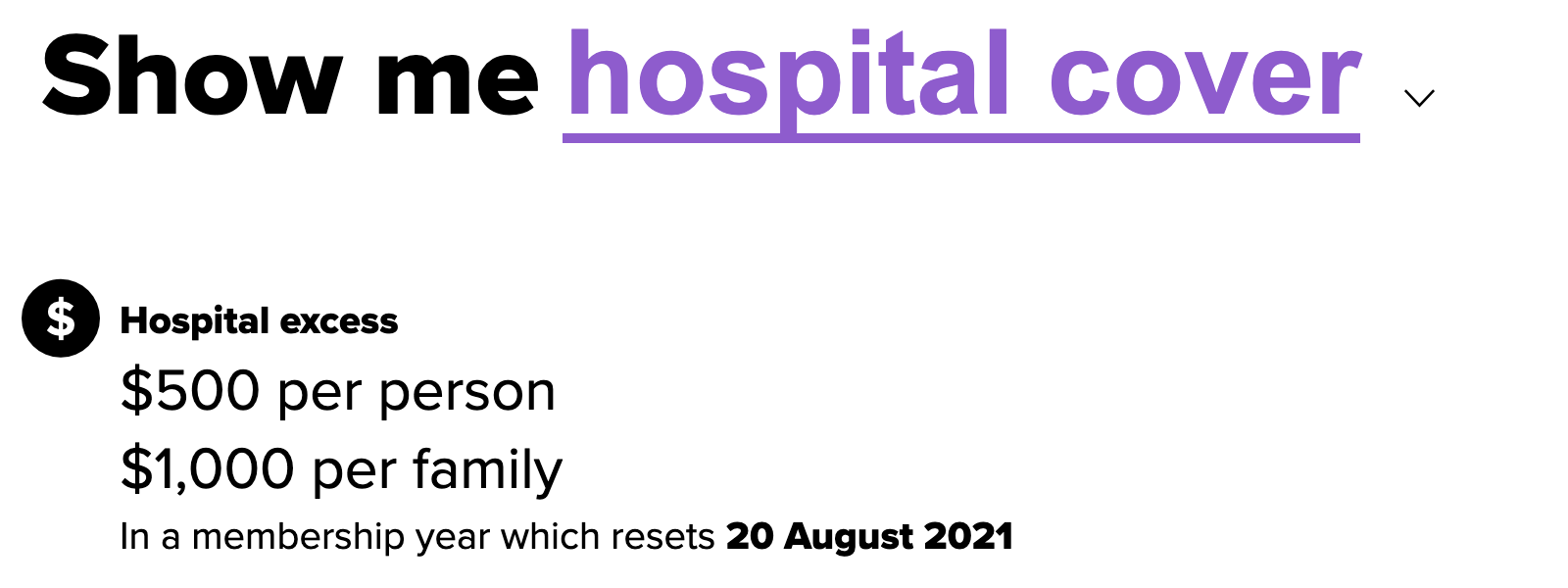

Your remaining individual annual limits are shown as a purple bar when you log in.

|

More people on your cover? It's easy to check the remaining limits for other policy members.

Click on the name section to see limits for each person on your cover. |

If you've purchased extras cover for the whole family, the way your annual limits work will depend on the cover you chose. A family limit is the total amount that can be claimed by all members on your cover. Family limits are only on certain extras products, but it's simple to check if you've got them.

If your cover has family limits, these are shown underneath the purple limits bar.

A waiting period is the amount of time you have to wait before we can help with the cost of items and services included under your cover. If you get any treatments or services during a waiting period, we won't be able to help out with the costs. It's easy to find out your extras waiting periods when you log in.

Services that don't have any waits remaining are shown in this section with a purple limit bar.

Services that have a waiting period are shown in this section with a black limit bar.

|

Switched from another fund? We might be waiting for your old fund to send us some of your info. This can take up to 21 days, and once we receive it, we’ll honour any equivalent waiting periods you served for services on your old cover. Some waiting periods may apply if your old cover was at a lower level or didn’t include services which are included on your new cover. |

We don't have providers you need to use, which means you can see anyone as long as they’re recognised by us.

So basically, you don’t have to go to the physio across town – you can go to one you like.

The important stuff about your hospital cover

Because you've got hospital cover with ahm, we’ll help with bills for things when you’re admitted to hospital as a private patient like doctor’s fees, accommodation, operating fees and intensive care.

The types of services included on your hospital cover depend on the level of cover you've got. Generally, the higher the level of cover, the more services you can claim towards.

Your hospital cover allows you to choose your specialist if you go to a private hospital.

Going to hospital? Call us first on 134 246 to check your treatment is included in your cover and no waiting periods apply. Read our Going to hospital guide.

You can check what hospital services we'll pay benefits towards as soon as you log in.

The amount we’re able to help with your bills will depend on what you’re claiming for, where you’re being treated, your cover and your waiting periods.

Out-of-pocket costs

While we’ll help with the cost of services and treatments included in your cover, you may still need to pay an amount out-of-pocket. You may experience an out-of-pocket cost if the bill for your treatment or service exceeds the benefits that we pay towards these under your cover, as well as any benefits payable by Medicare.

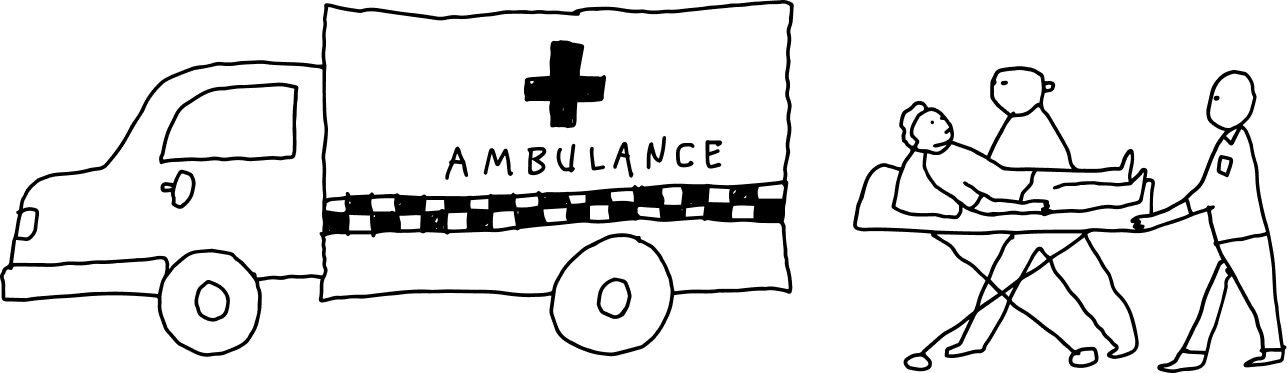

Excess

Excess refers to the flat, up-front cost you may need to pay when you’re admitted to a hospital and you want to use your hospital cover. Excess options are different depending on your needs and budget.

Excess is displayed in this section along with membership year and when it resets.

Take note of any waiting periods that apply to your hospital cover. A waiting period is a set amount of time you must wait before we can help with the cost of items and services that are included under your cover. We can’t help out with any items, treatments or services you receive during a waiting period.

|

Switched from another fund? We might be waiting for your old fund to send us some of your info. This can take up to 21 days, and once we receive it, we’ll honour any equivalent waiting periods you served for services on your old cover. Some waiting periods may apply if your old cover was at a lower level or didn’t include services which are included on your new cover. |

'Pre-existing condition' refers to any ailment, illness or condition that you showed signs or symptoms of in the 6 months before you joined ahm or changed your cover.

If a Medical Practitioner appointed by ahm determines you have a pre-existing condition, you’ll need to wait 12 months from the date that you joined ahm or changed your cover before you can claim benefits for treatment for that service on your hospital cover if you’ve:

- taken out private hospital cover for the first time; or

- changed to a cover that has additional services, and you want to claim for these.

For more information on pre-existing conditions, check your member guide or contact us.

For more info, message us or call 13 42 46 weekdays, 8am – 7pm (AEST/AEDT).